TBM 700 Series, TBM 850, TBM 900 Series, TBM 960

TBM 700 series inventory has surged yet pricing remains stable as we head into the third quarter of 2025. There are now 25 combined listings between the 700A, 700B and 700C2 markets. This is up from just 18 listings last quarter, and up 150% from a year ago. Transactions have remained in check with this additional inventory, with six sales during Q2. This falls in line with the prior three quarters, but a couple sales behind Q2 2024. So far, pricing remains stable, especially low-engine time airplanes with upgraded avionics. With plenty of options to choose and stable pricing, this market remains balanced for buyers and sellers.

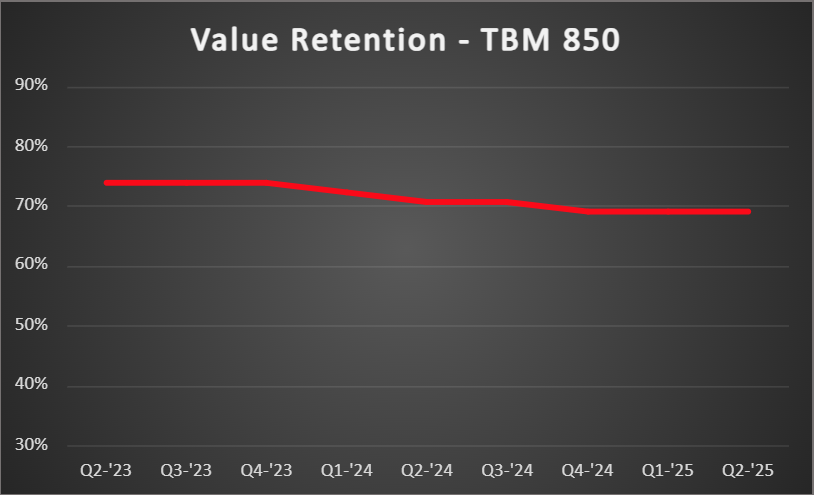

TBM 850 inventory has bounced back after temporarily dipping in the first quarter. There are now 21 listings, up from an active Q1 where inventory got depleted down to just 16 listings. Coming off the lowest inventory level in two years, Q2 only produced four sales, compared to the unusually busy Q1 where 11 transactions took place. Pricing has held stable, with the exception of aircraft nearing overhauls, as more and more 850’s are getting into TBO range. With ample supply and stable pricing, this market is considered balanced for buyers and sellers.

TBM 900 series inventory continues to climb, and transactions have cooled off a bit. There are now 32 combined listings between these four markets, representing 7.5% of the active fleet, the highest in many years. Transactions took a step backwards in Q2, with 14 sales taking place, down from 17 in Q1 and 16 back in Q2 of 2024. Not surprisingly, values have dropped considerably, down roughly 5% over the past 90 days. This was the most significant drop in these markets in recent years, which shows just how stable these TBM markets have been over the years. We don’t expect much further price concessions for the rest of the year, as these markets have been historically resilient following similar price drops.

The pre-owned TBM 960 market remains red hot as it has since its debut back in 2022. There are currently no used options in this market, down from two listings during Q1. This market has stayed mostly depleted over the past few years, with the exception of Q4 2024 where a handful were listed, but sold quickly. With such few options to choose from, it’s expected there aren’t many transactions. Only one sale in Q2, making just two total on the year. Q4 2024 was active with seven pre-owned sales taking place, which showed us strong demand and stable pricing is the theme of this market. With practically no options to choose from, and unwavering pricing, this market remains very favorable for sellers.