Citation M2, Citation CJ2+, Citation CJ3, Citation CJ4

The Citation M2 market continues to be very active. Q2 saw ten sales, which was two fewer than the previous quarter. Inventory has held steady for the past two quarters, with an average of 13 units listed for sale, which represents 4.3% of the fleet. Pricing has seen moderate gains for the past five quarters. This would be a good time to purchase an M2, as there is still a decent selection of inventory.

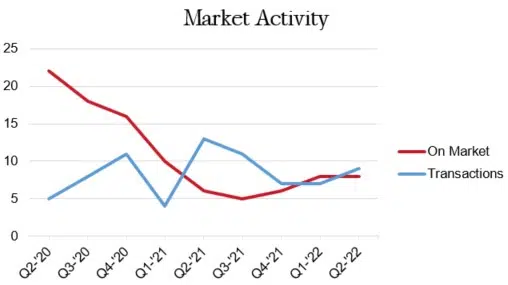

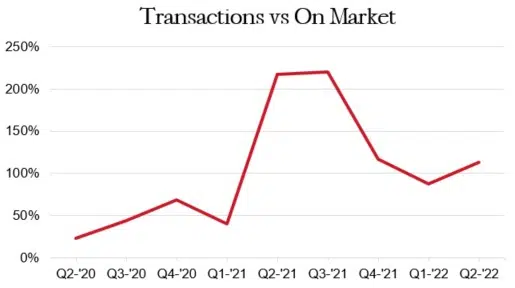

The CJ2+ market continues to be extremely tight. There were only four aircraft available in Q2, which represents only 1.8% of the active fleet. There were five sales in Q2, which is two more than the previous quarter, but off three from a year ago. Pricing continues to rise, as the CJ2+ saw a modest gain for Q2. This would be a good time to sell, as inventory levels continue to remain low.

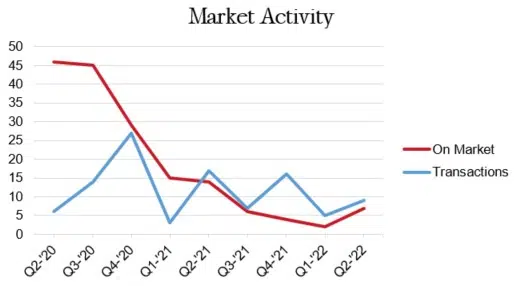

After a record number of sales in 2020, the CJ3 market has slowed significantly, with only 14 sales for the first half of 2022. There was an average of only seven units available for sale this past quarter, which although up five units from the previous quarter, is still less than two percent of the total fleet. Nine units traded last quarter, which is four more than the previous quarter, and eight fewer than a year ago. Pricing for this market has increased considerably. This is an excellent time to sell a CJ3, as the inventory levels are still at near record lows.

The Citation CJ4 market continues to be active. Q2 averaged eight units available for sale, which is the same as last month, and represents 2.4% of the active fleet. Nine sold in Q2, which is two more than the previous quarter, and off four units from a year ago. Pricing continues to increase, with moderate gains in the past five quarters. This would be a good time to sell a CJ4, as the inventory is still sparse, and prices are strong.