Citation Excel, Citation XLS, Citation XLS+, Citation Sovereign, Citation Sovereign+, Citation X

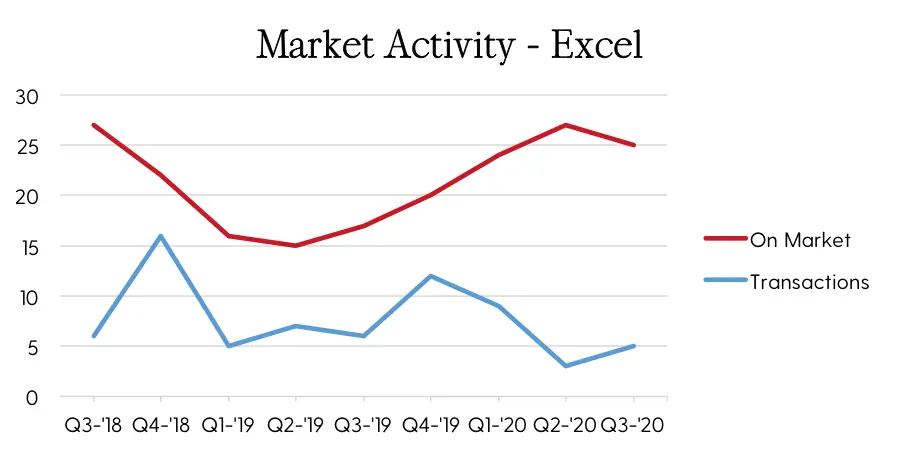

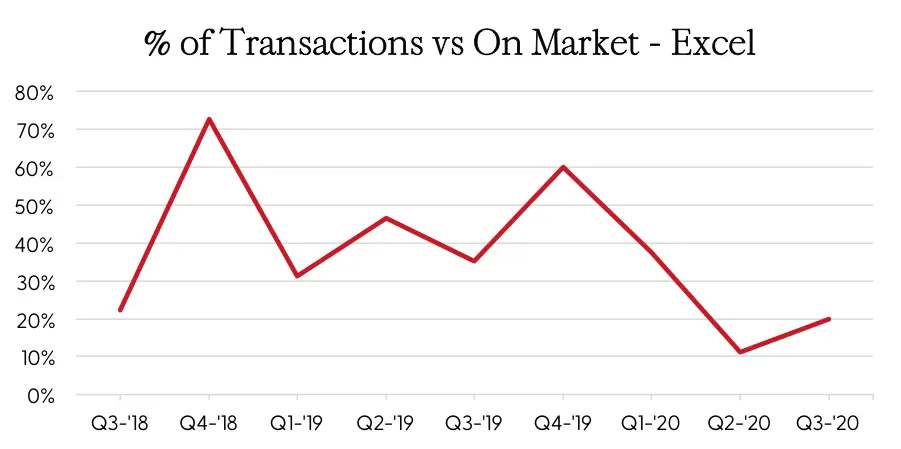

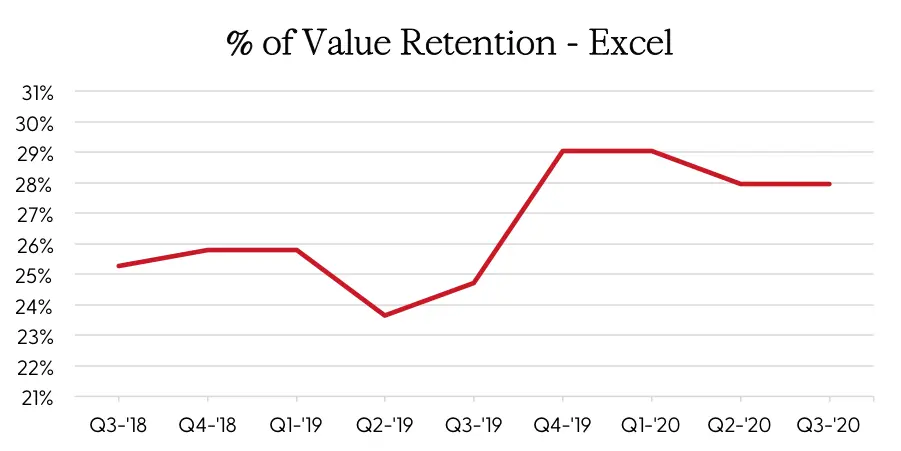

The Citation Excel retail transactions have rebounded slightly after dropping in the first two quarters of 2020. Five aircraft sold in the third quarter, two more than last quarter, and one fewer than a year ago. Q3 averaged 25 Excel aircraft for sale, which represents 7% of the active fleet. The number available for sale has remained fairly steady since the first of the year. 20% of the available aircraft sold in the third quarter. Pricing has remained stable for the last two quarters after haven fallen slightly in Q2. With ample inventory, and fewer buyers, this would be an excellent time to purchase an Excel.

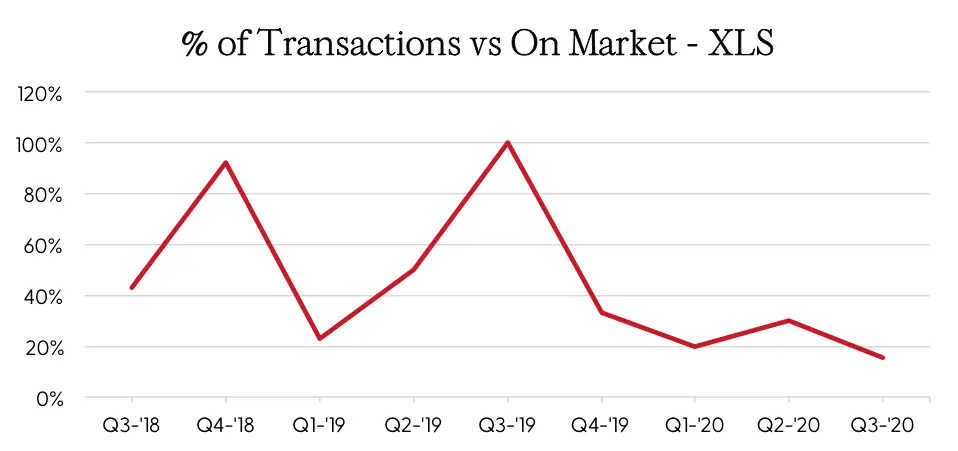

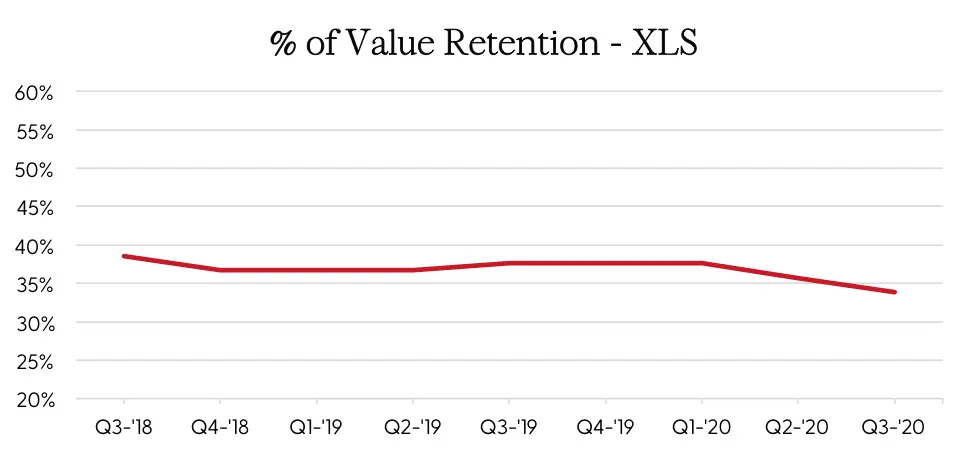

The Citation XLS retail transactions have remained sluggish for the past four quarters. Only two aircraft sold in the third quarter, which seven fewer than a year ago. Q3 averaged 13 of the Citation XLS aircraft for sale, which represents just 4% of the active fleet. The number available for sale has increased moderately when compared to a year ago, with 13 on the market. Just 15% of the available aircraft sold in the third quarter. Pricing for the XLS has decreased for the past two quarters. Like the Excel, good selection and fewer transactions make it an attractive time to purchase.

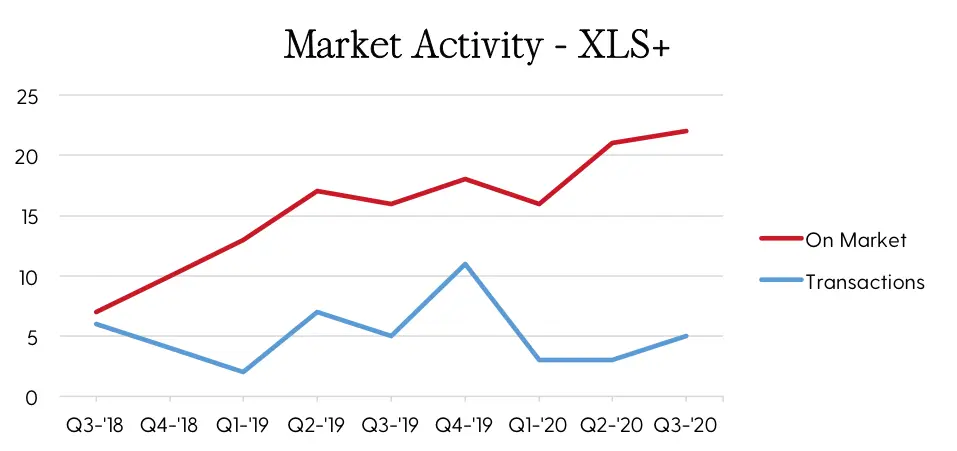

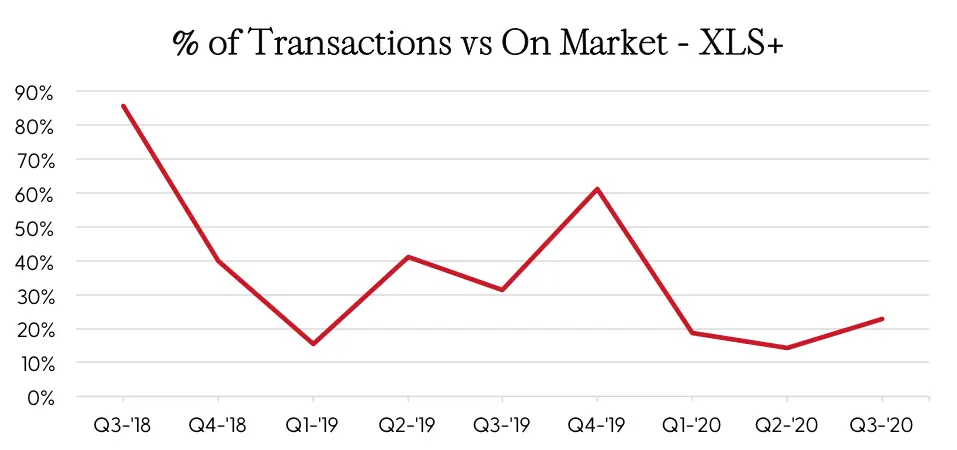

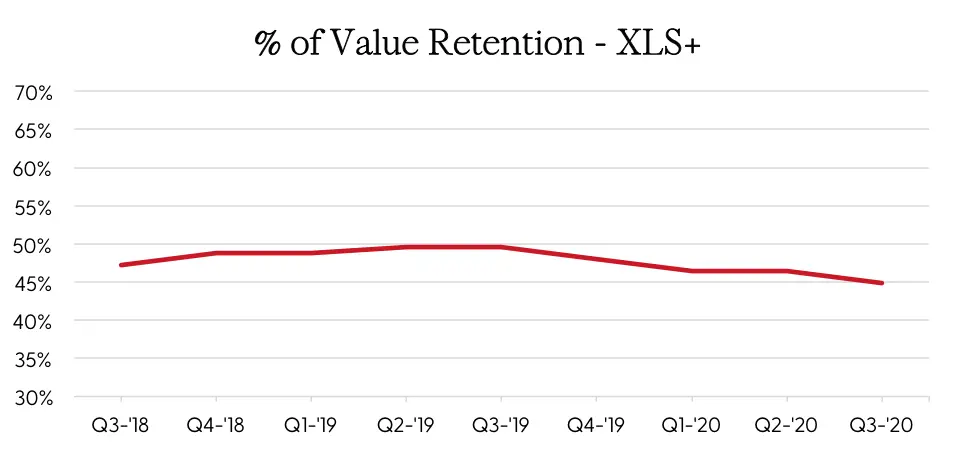

The Citation XLS+ retail transactions have been up slightly in the third quarter, but are still relatively slow. Five aircraft sold in the third quarter, which is the same as a year ago. However, Q3 averaged 22 of the Citation XLS+ aircraft for sale, which is an all-time record number of units. The number available for sale has increased by six units when compared to Q3 of 2019. 23% of the available aircraft sold in the third quarter. Pricing has decreased slightly in Q3. Demand continues in the XLS+ market, but supply has increased moderately. This represents an excellent opportunity for a buyer, as pricing is softening, and there is a more than ample supply of aircraft.

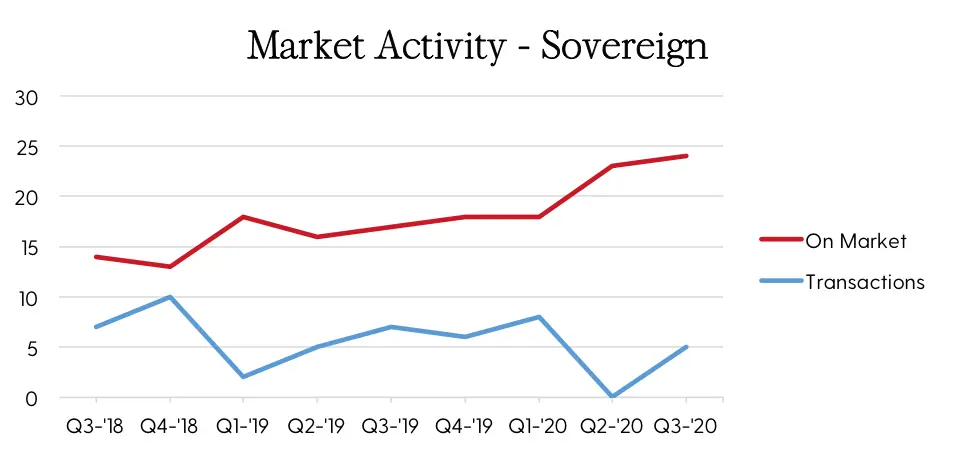

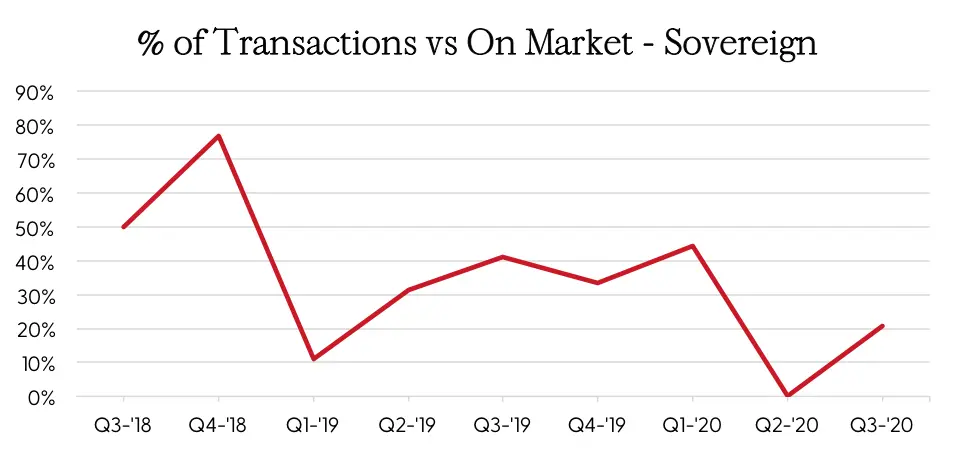

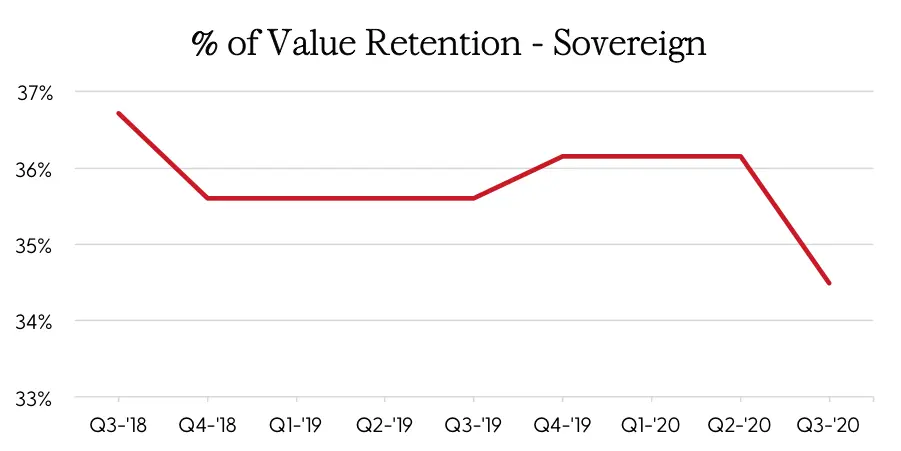

The Citation Sovereign retail transactions have returned with a vengeance in Q3, after no sales in Q2. Five aircraft transacted last quarter, which is 21% of the availability. Q3 averaged 24 Citation Sovereign aircraft for sale, which is 7% of the fleet, and is the most offered in over two years. The number available for sale is seven more than a year ago. After holding steady for half of the year, pricing softened last quarter. This is a good time to purchase a Citation Sovereign, with excellent supply and softening pricing.

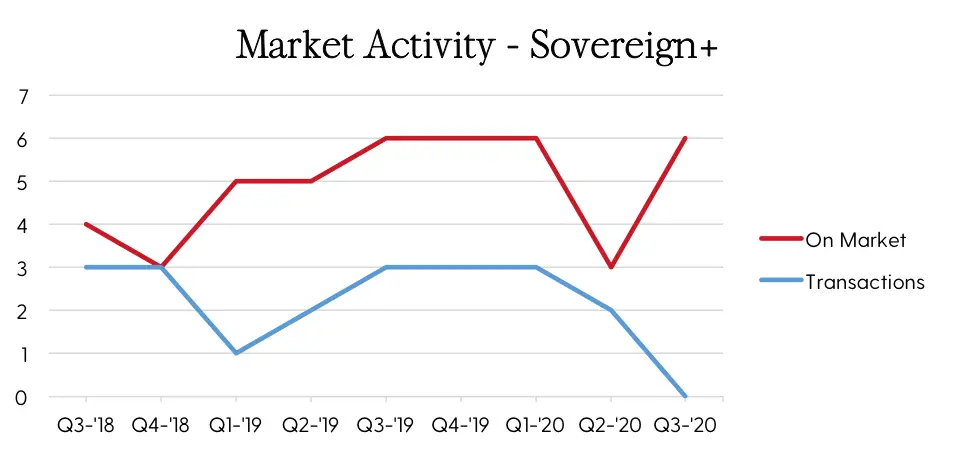

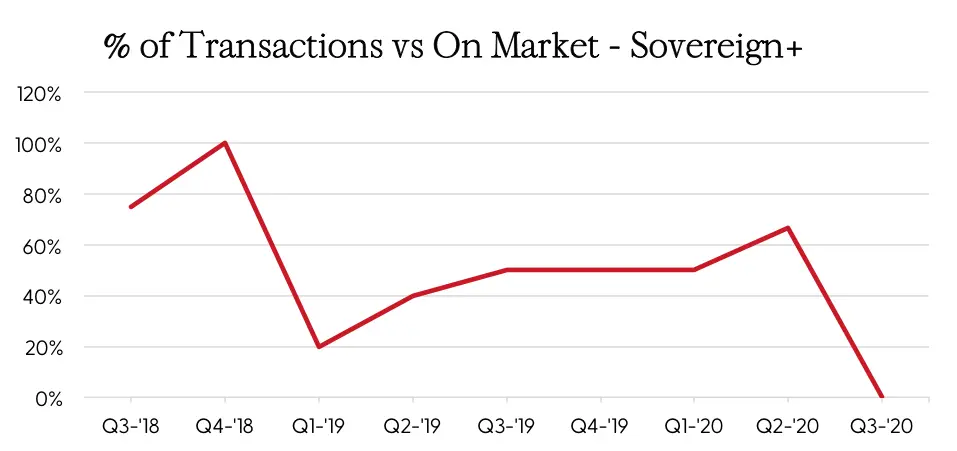

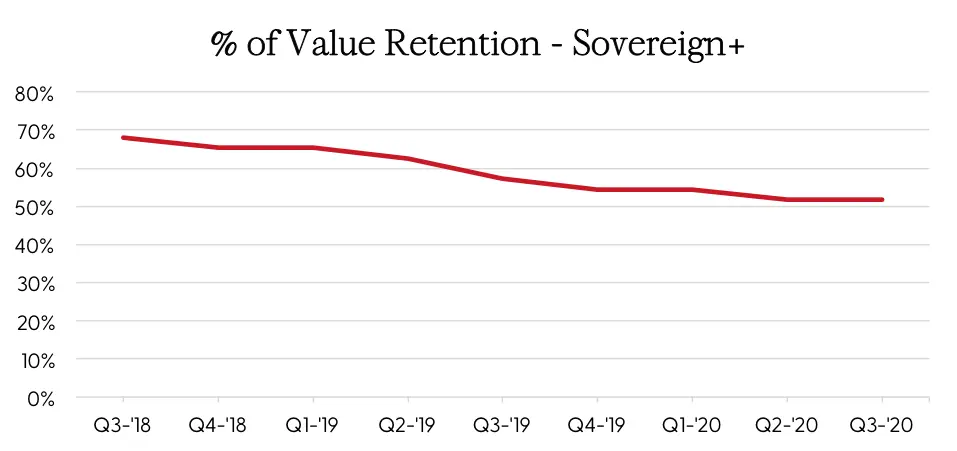

The Citation Sovereign+ retail transactions have been declining since the first quarter of 2020. In fact, there were no retail sales last month. Q3 was the first quarter in over two years where there were no retail sales for this aircraft. Q3 averaged six CitationSovereign+ aircraft for sale, which represents 6% of the active fleet. The number available for sale increased last quarter, but is on par with the previous three quarters. After declining in Q2, pricing has held steady. Although there are only six aircraft offered for sale, the lack of sales in Q3 may provide some buying opportunities.

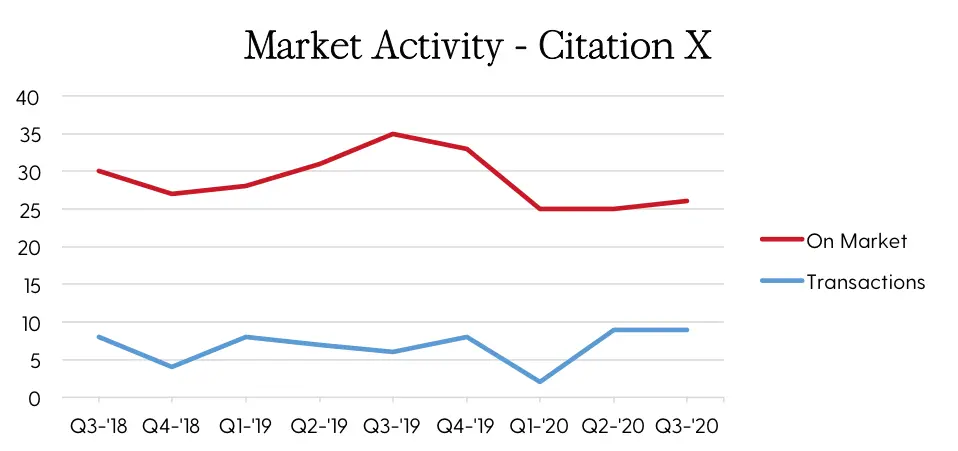

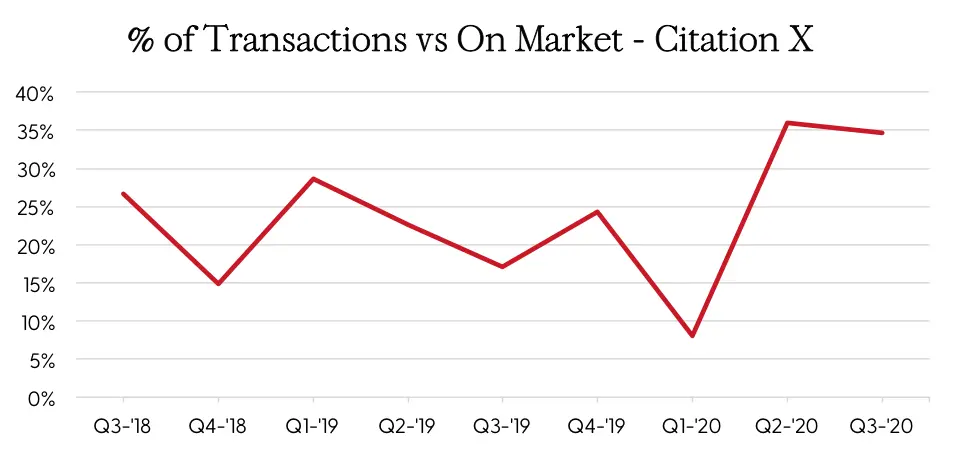

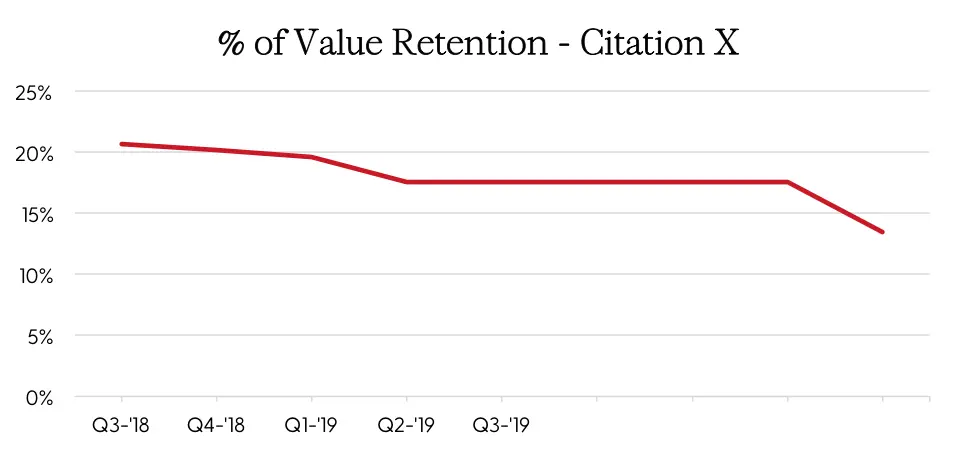

The Citation X market is somewhat of an anomaly in Q3. Inventory levels, although up one unit in Q3, have dropped significantly since Q4, 2019, and the number of retail sales exceeds pre COVID-19 levels. Nine aircraft sold in Q3, which is the same as Q2, and is three more than a year ago. Q3 averaged 26 Citation X aircraft for sale, which represents 8% of the active fleet. The number available for sale has remained steady after a sharp decrease in Q1. Pricing has fallen significantly, which may account for some on the current market activity. This is a good time to be in the Citation X market with both buying and selling opportunities.